Commercial Insurance Underwriting Powered by AI

Made Possible by Human-in-the-loop

Advancing Underwriting with Purpose-Driven Innovation

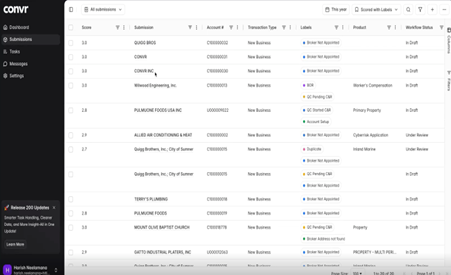

Convr AI is transforming the insurance industry through data, discovery and decisioning. Integrating advanced AI, real-time data analytics, and automated workflows to transform risk assessment and decision-making.

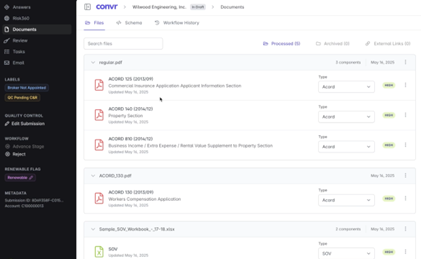

Pre-Filled Submissions

Generative AI structures insights for faster, more accurate underwriting.

Proactive Recommendations

With Agentic AI, recommended actions reduce manual work and accelerate underwriting decisions.

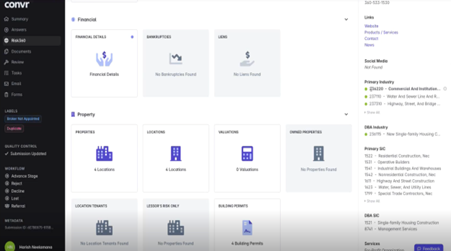

Dynamic Risk Profiles

Large Language Models deliver adaptive, up-to-the-moment risk profiles.

Decision Transparency

Explainable AI expose the reasons decisions are made, data source derivation and confidence level.

Convr systematically extracts and structures data from ACORDs, loss runs, SOVs, etc. and enriches it with domain-specific information throughout the underwriting process. Workflows benefit from in-line data, recommendations, collaboration, compliance alignment, as well as dynamic relational data derived from our proprietary data lake with more than 85 million businesses to accelerate automated underwriting.

"In 2024 we processed more new submissions than ever in the history of the company and a large part of that was our partnership with Convr." Manager, Training and Infrastructure.

Convr empowers MGAs by automating data intake and providing critical insights that accelerate underwriting decisions. This efficiency helps MGAs scale their operations, improve profitability.

"Lucid is using Convr's Intake AI to automate the entire underwriting process, eliminating human touch along the way." said John Stammen, Chief Executive Officer at Convr

Convr empowers MGAs by automating data intake and providing critical insights that accelerate underwriting decisions. This efficiency helps MGAS scale their operations with higher production and improved profitability.

Lockton is expanding its relationship with Convr AI for efficiencies with increased data extraction and enrichment.

Schedule a Demo?

Let's discuss how Convr can fit your goals. Complete this form and someone will get back to you.